Opinion

USA – -(Ammoland.com)- The greatest threat to the Trump recovery is reckless action by the Federal Reserve System, which could choke off economic growth.

There is a distinction between the headlines created by stock market ups and downs and the real threat from Federal Reserve policy changes that will raise interest rates and withdraw money from the banking system.

The current correction in the stock market is probably a healthy step.

We have had an enormous increase of more than 8,000 points in the Dow Jones Industrial Average since the election (up from 18,332.74 on November 8, 2016 to a high of 26,616.71 on January 26, 2018). That is a 45 percent increase in a little more than 14 months. A correction is more than reasonable. Some overvalued stocks will take a hit (and should). Other stocks will fall into a more affordable range and draw in new money from people seeking bargains.

The real danger is not a substantial correction (remember the market would have to fall 8,000 points just to get to the 2016 Election Day level).

The real danger is that the underlying signal that led to the correction was the news that the Federal Reserve was going to tighten the money supply and raise interest rates.

When done slowly and cautiously, these are necessary steps back toward a more traditional system.

The Fed responded to the banking crisis of 2007 with massive injections of cheap money and extraordinarily low interest rates. In effect, the Fed was giving away cheap money to avoid the kind of credit crunch which had turned the 1929 recession into a Great Depression.

Then Federal Reserve Chairman Ben Bernanke was a student of depression-era policies, and he was determined to inject as much liquidity as necessary. In fact, in 2002, when Bernanke was a Federal Reserve governor, he said if necessary, he could print dollars and drop them from a helicopter, so people had liquidity. Bernanke was referencing an idea developed by economist Milton Friedman, who was the first to introduce the “helicopter money” concept in monetary policy.

This attitude led to an enormous injection of money into the worldwide system. Smart investors took advantage of the cheap money and got even richer.

Now, as the economy recovers, the Fed is reverting to its normal fear of prosperity.

Back in the 1970s and 1980s, then-Congressman Jack Kemp and I argued that the attitude of the Federal Reserve was both wrong intellectually and wrong in practical effect.

The dominant Fed theory is that too much economic growth is dangerous because it leads to inflation. Therefore, every time the economy starts growing substantially, the Fed should raise interest rates to “cool it off.”

Since many Fed economists agree with former Secretary of the Treasury Larry Summers that stagnant growth is the “new normal,” they believe it is essential that interest rates be raised every time the economy starts to really grow.

President Trump’s policies are exactly the opposite. Trumpian economics starts with a belief that the “Obama normal” that Summers is describing is a result of bad left-wing policies.

The Trump program of lower taxes, deregulation, job training, and workforce reform is designed to get to 4 percent or even 5 percent growth.

If President Trump is pushing for a rapidly expanding, full-employment economy, and the Fed theoreticians are determined to “cool off” the Trump exuberance, there will be a real confrontation.

All this was brought home to me when I read John Mauldin’s “Thoughts from the Frontline” newsletter on February 3 entitled “Enjoy It While You Can.”

John is a good friend and a remarkable student of markets and economies. He has an amazing worldwide network of friends who make their living in various markets. Their practical understanding of the real world is dramatically better than the limited view of academic theoreticians at the Federal Reserve.

In his newsletter, John explains how the normal economic signals that the Federal Reserve looks at to determine if there is a danger of inflation are currently distorted by the low labor force participation rate and the number of people working multiple part-time jobs. He also explains why raising rates too high and withdrawing money too fast would be devastating to growth.

I urge you to read Mauldin’s newsletter and watch for the potential collision between the President and the Federal Reserve.

In the 1950s, every time President Eisenhower got the economy growing, the Federal Reserve would raise interest rates and push the economy into a recession.

President George H.W. Bush was defeated for re-election in part because the Federal Reserve kept interest rates too high, which pushed the economy into a recession.

President Trump, his Cabinet, and the Congressional Republicans should all keep an eye on the Fed. The Republican tax, regulatory, and work force reforms are working. It is important that they make sure the Federal Reserve doesn’t create a real slowdown based on obsolete academic theories.

The success of the economy, the opportunities for working Americans and their families, and the election potential for the President and Congressional Republicans are all affected by the next series of Fed actions.

I will write more about them as they evolve.

In the meantime, read Mauldin’s “Thoughts From the Frontline,” and you will get real insights as the process unfolds.

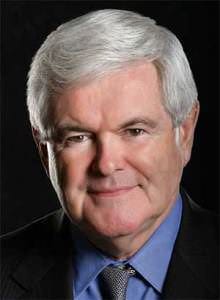

Your Friend,

Newt

P.S. Copies of Callista’s new children’s book, Hail to the Chief, and my new book Understanding Trump are now available

About Newt Gingrich

Newt Gingrich is well-known as the architect of the “Contract with America” that led the Republican Party to victory in 1994 by capturing the majority in the U.S. House of Representatives for the first time in forty years. After he was elected Speaker, he disrupted the status quo by moving power out of Washington and back to the American people.

Gingrich Productions is a performance and production company featuring the work of Newt Gingrich and Callista Gingrich. Visit : www.gingrichproductions.com

The post Don’t Focus on Stocks: Focus on The Federal Reserve & Prosperity appeared first on AmmoLand.com.